Tidewater has established an investment platform which allows its participants to access a wide range of opportunities. Across our platform, we look for deals that provide a compelling risk-reward profile.

Our firm engages in the following types of private investing:

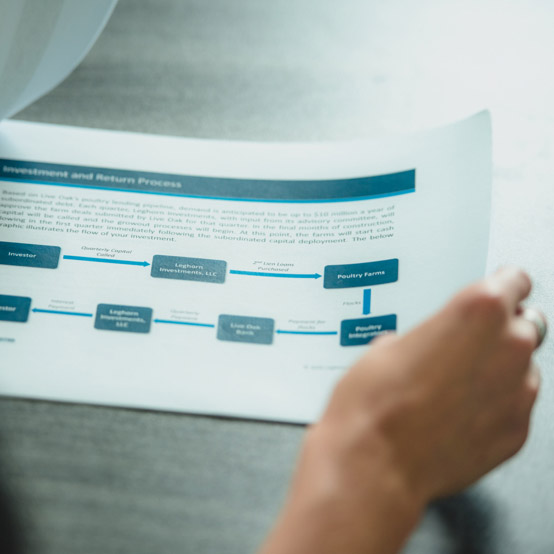

Subordinated Debt

Sector Focus: Established industries with little to no market force change

Geographic Focus: Continental United States

Investment Structure: A single-purpose LLC that holds a basket of loans in a certain industry or vertical

Deal Structure: Subordinated Debt to a Strong Senior Lender

Target Holding Period: 3 to 5 Years

Target Interest Rates: Low to Mid Double Digits

Private Equity

Sector Focus: Light Manufacturing, Distribution and Logistics, Healthcare, Tech-Enabled Services, Food & Beverage Production, Financial Services

Stage Focus: Mid-to-Late Growth Stage

Geographic Focus: Southeast, Mid-Atlantic

Financial Characteristics: $10-30 million in annual revenue; $2-4 million in EBITDA

Deal Structure: Full or Majority Buyout

Participation: Management Consulting, Majority Board Participation

Growth Capital

Sector Focus: Light Manufacturing, Distribution and Logistics, Healthcare, Tech-Enabled Services, Food & Beverage Production, Financial Services

Stage Focus: Revenue and EBITDA Expansion Stage

Geographic Focus: Southeast, Mid-Atlantic

Business Characteristics: Growing, Profitable Business, Scalable Business Model, Management Team in Place

Type of Tidewater Investment: Targeted Use of Proceeds, Minority Interest Participation, Preferred Equity or Convertible Debt

Participation: Board of Directors seat or Observer Rights

Venture Capital

Sector Focus: Healthcare, Biotech, Information Technology

Stage Focus: Late to Pre-Exit

Geographic Focus: Established technology clusters such as Boston, San Diego, Austin, Atlanta, Minneapolis, and Raleigh-Durham.

Syndication: We only invest with Blue Chip Partners with whom we have prior experience

Participation: Board of Directors seat or Observer Rights